By NexGen Support Team

January 16, 2025

Dealing with income tax can feel hard, especially for businesses that use non-employee compensation. Every tax year, companies work with independent contractors, freelancers, and self-employed people. They have to report certain details on Form 1099 NEC. In this blog post, you will find a everything you need to know about filing and reporting on 1099-NEC form. As a complete guide for contractors and businesses, it will help you understand how it differs from 1099-MISC, why it is needed, what to do when filing, and common mistakes you should avoid. This way, you can make your tax season easier.

Taxes for independent contractors should be reported using IRS Tax Form 1099 NEC

1099-NEC is a form that businesses use to report payments made to independent contractors for services during a calendar year. This document is important to keep things clear with the IRS about non-employee compensation. It also helps businesses understand their federal income tax responsibilities. Earlier, such payments were reported in box 7 of the form 1099-MISC.

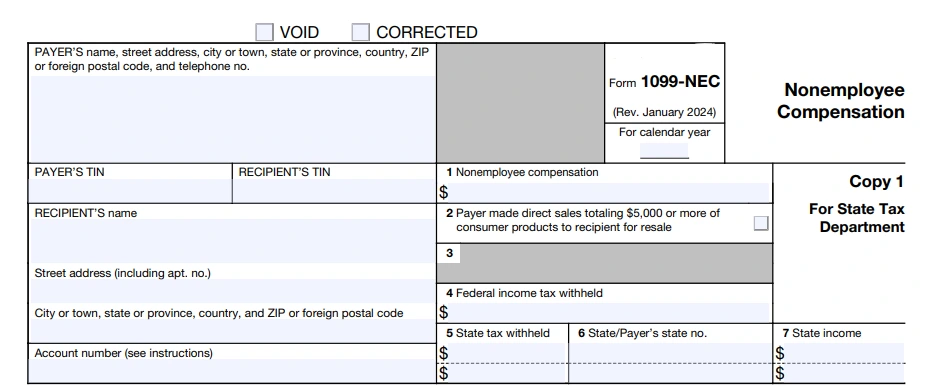

If a business pays an independent contractor $600 or more by the end of the tax year, it must file Form 1099-NEC with the IRS. They should also give a copy of this form to the contractor. This form has important details. It includes the taxpayer identification number (TIN) for the payer and the contractor. It also lists the total amount paid and any federal income tax that was withheld.

This form is used to track payments made to contractors by the IRS. It helps make sure that contractors follow IRS rules. When you report accurately, it promotes fair taxes, helps strengthen finances, and supports important services.

1099-NEC is an important tool for the Internal Revenue Service (IRS). It helps keep track of the income that people and businesses earn. This form records the money paid to independent contractors. The IRS compares this information with the contractor’s tax return.

For businesses, filling out this IRS form 1099 is important. It helps them follow tax rules. This way, they can avoid fines. It also helps ensure that non-employee compensation payments are fair and responsible.

When businesses report these payments, the IRS can improve tax laws. This system ensures that everyone pays their taxes. As a result, it helps the government get the money it needs for important services.

Nonemployee compensation is the money given to independent contractors, freelancers, and self-employed individuals for their services. It’s important to understand that this payment differs from what regular employees earn as there are different tax rules for each type of work.

Employees have income tax, Social Security, and Medicare taxes taken from their paychecks and are issued a Form W-2. Independent contractors, on the other hand, must manage these taxes themselves. Unlike payroll taxes, the business does not withhold such taxes from what it pays these workers.

The business uses 1099 NEC to show the total amount of nonemployee compensation paid during the tax year. This form helps independent contractors know how much tax they must pay when they file their tax returns.

Before 2020, businesses used Form 1099-MISC to report non-employee compensation. This changed when 1099-NEC was brought back. Now, 1099-MISC mainly deals with other types of payments known as miscellaneous income.

Understanding the difference between 1099 NEC and 1099 MISC is important for clear reporting. Here’s a table that shows the main differences:

| Feature | 1099-NEC | 1099-MISC |

|---|---|---|

| Purpose | Non-employee Compensation | Miscellaneous Income |

| Examples | Payments to freelancers, contractors | Rents, royalties, prizes, awards, fishing boat proceeds |

Both 1099 forms must follow backup withholding rules. This means the payer might need to hold back taxes. This happens if the payee does not give a valid taxpayer identification number (TIN).

It is important to find out if your business needs to file 1099-NEC for taxes.

However, there are some exceptions.

To understand your specific situation, check IRS rules for 1099-NEC or talk to a tax professional.

Many small businesses use freelancers. It is important to understand the 1099-NEC rules. First, contractors must work as independent people. You must have paid them at least $600 each year. This rule is for individuals, partnerships, or single-member LLCs. Make sure to get a W-9 form before you make any payment. This form gathers their information such as name, address, Taxpayer Identification Number (TIN), etc.

A common mistake is believing you only need to fill out Form 1099-NEC if you withheld taxes from the contractor’s payments. The reality is that you must file it based on the total amount you paid, regardless of whether you took out any tax.

Another mistake is thinking that businesses can file until the regular tax filing deadline. The due date for filing information returns, like 1099-NEC, is usually January 31st. If this date falls on a weekend or a holiday, the due date shifts to the following business day.

Form 1099-NEC should be filed by the deadline for payments to independent contractors to avoid penalties

Filing this tax form 1099 is simple. First, gather all the information you need. This includes your business info, the contractor’s TIN, and the total payment amount.

Next, you need to choose between filing electronically through the IRS Filing Information Returns Electronically (FIRE) System or using paper forms from the IRS. Remember to register with the FIRE system in advance if you want to file electronically. You can also e-file information returns for tax year 2022 and later with the Information Returns Intake System (IRIS). The system also lets you file corrections and request automatic extensions.

Starting Tax Year (TY) 2023, if you have 10 or more information returns, you must file them electronically.

Before you file taxes, collect all the documents you need to avoid delays.

Having the finished W-9 from contractors is very important. It checks their TIN and makes sure they are exempt from backup withholding. It’s good to keep a detailed record of contractor payments for the 1099-NEC reporting.

This form helps you and contractors report income correctly on tax returns. You may need information from your 1099-NEC to fill out Schedule C. This form shows your business profit or loss when you file your Form 1040.

Choosing how to file depends on your business needs. Electronic filing is fast and simple. It is a good choice for businesses that handle many forms.

Paper filing can work well for people who have only a few forms. It requires careful attention. You also need to mail it on time to meet the filing deadline. You must also submit an additional summary Form 1096 with each paper form filing.

Here’s a quick look at the differences:

Electronic Filing:

Paper Filing:

Ultimately, it doesn’t matter if you choose electronic or paper filing. Just make sure you are accurate. Submit by the due date.

You must file Copy A of the 1099-NEC with the IRS and also send Copy B to the payees. Usually, the deadline is January 31st for prior year payments. Failing to send Form 1099-NEC on time or with mistakes can lead to fines from the IRS. The penalties will change depending on how late it is and if there are unpaid taxes. You may face penalties for late filing and non-compliance that ranging from $50 to $580 for each form. If you intentionally ignore the rules, the fines will be even higher.

Breaking the rules might get the IRS to pay close attention, which could result in an audit. Businesses could also face legal problems for not paying taxes properly on purpose. To avoid these issues, it is important to understand and meet your duties about contractor payments, backup withholding, and filing 1099 NEC accurately.

Before businesses pay independent workers, they must get Form W-9. This form gathers their information, including name, address, and Taxpayer Identification Number (TIN), which may include their Social Security Number (SSN) or Employer Identification Number (EIN). This ensures that non-employee compensation is reported accurately to the IRS, and the Social Security Administration (SSA) can track contributions to Social Security and Medicare. It also makes sure that there is no backup withholding.

In addition to 1099-NEC, you might need other 1099 tax forms based on your payments and where the contractor is located. For example, if you sell more than $5,000 directly, you may need to file 1099-MISC form. Each state has its own rules. It is a good idea to check with your state tax department for more details for compliance with the state income tax rules.

Understanding Form 1099 NEC is important for easy tax reporting. This form is used for nonemployee compensation. It plays a big role in following tax rules. You need to know who has to file it and how it’s different from Form 1099-MISC. Pay attention to the deadlines and penalties for submitting the 1099 forms. To make your taxes easier, gather all the necessary documents. Think about the benefits of filing electronically. NexGen Taxes can help you keep your books on track and provide details of payments that require you to file these forms accurately and on time through their bookkeeping services. This way, you can avoid penalties. Stay informed about 1099-NEC to get through tax season with ease.

NexGen Taxes provides full tax services for small business owners, freelancers, and independent contractors. We help you with classifying workers. We also guide you on your tax duties for contractor payments. Plus, we make sure Form 1099-NEC is filled out and filed correctly.

Our team of experienced CPAs and tax advisors offers personalized financial advice and support to help you navigate through complex tax rules. By partnering with NexGen Taxes, you can streamline your financial operations and ensure compliance with changing rules and regulations. Choose NexGen Taxes for expert help. We support you during tax season. This lets you focus on what matters most – growing your business!

If you make a mistake and notice the error after the due date, you need to fill out a 1099-NEC amendment and send it to the IRS. Make sure to fix any wrong details, like the taxpayer identification number or payment amount. After you correct it, send the updated form to the IRS and the contractor.

Form 1099-NEC is not usually for international contractors. They have different tax rules and need other forms. One of these forms is 1042-S. It is used for nonemployee compensation paid to foreign individuals or companies.

For small businesses, the total nonemployee compensation listed on 1099-NEC forms is usually considered a business expense. This can help reduce your federal income tax. If you are self-employed, you must report this income on Schedule C of your tax return.

Small business owners and anyone who pays independent contractors more than $600 in a tax year need to file this IRS form. You must submit it by January 31st.

You will receive a 1099-NEC form if you earn more than $600 as an independent contractor. Provide your taxpayer identification number (TIN) for this to happen. You must include it on your tax return. This will help you determine how much federal income tax you need to pay.

If you have two incomes, you get money from two sources. You must report your W-2 income along with your 1099-NEC income on your tax return. Also, remember to include self-employment taxes. These taxes are for Social Security and Medicare taxes that apply when you report your 1099-NEC income.

Missing the filing deadline can lead to penalties from the IRS. This deadline usually falls on the next business day after January 31st of the tax year. If you want to learn more about these penalties, it’s smart to get legal services.

You need to send this form to any service provider who is not your employee. This applies if you paid them $600 or more during the tax year for services related to your business. This includes individuals, partnerships, and LLCs.

You need a 1099-NEC if you make direct sales of $5,000 or more in consumer products for resale. For example, if you sell cosmetics in large amounts to an independent distributor who then sells them to customers, you will probably need to provide a 1099-NEC.

You can use IRS-approved e-filing services or software to submit your forms electronically. Make sure to have all the required information handy, such as the recipient’s details and payment amounts. E-filing helps you meet deadlines and ensures accurate submission of your tax forms.

Freelancers must report their income to the IRS, including payments meeting the 1099-NEC threshold. If a freelancer earns $600 or more from a client during the tax year, they should expect to receive a 1099-NEC. Keeping track of earnings and accurately reporting them on tax returns is crucial for compliance.

The IRS 1099-NEC deadline for 2024 is January 31, 2025. Timely and accurate filing is crucial to comply with IRS regulations and avoid penalties. Using IRS-approved e-filing services or software can streamline the process and ensure efficient deadline compliance.

© 2022-2026 NexGen Unlimited, LLC