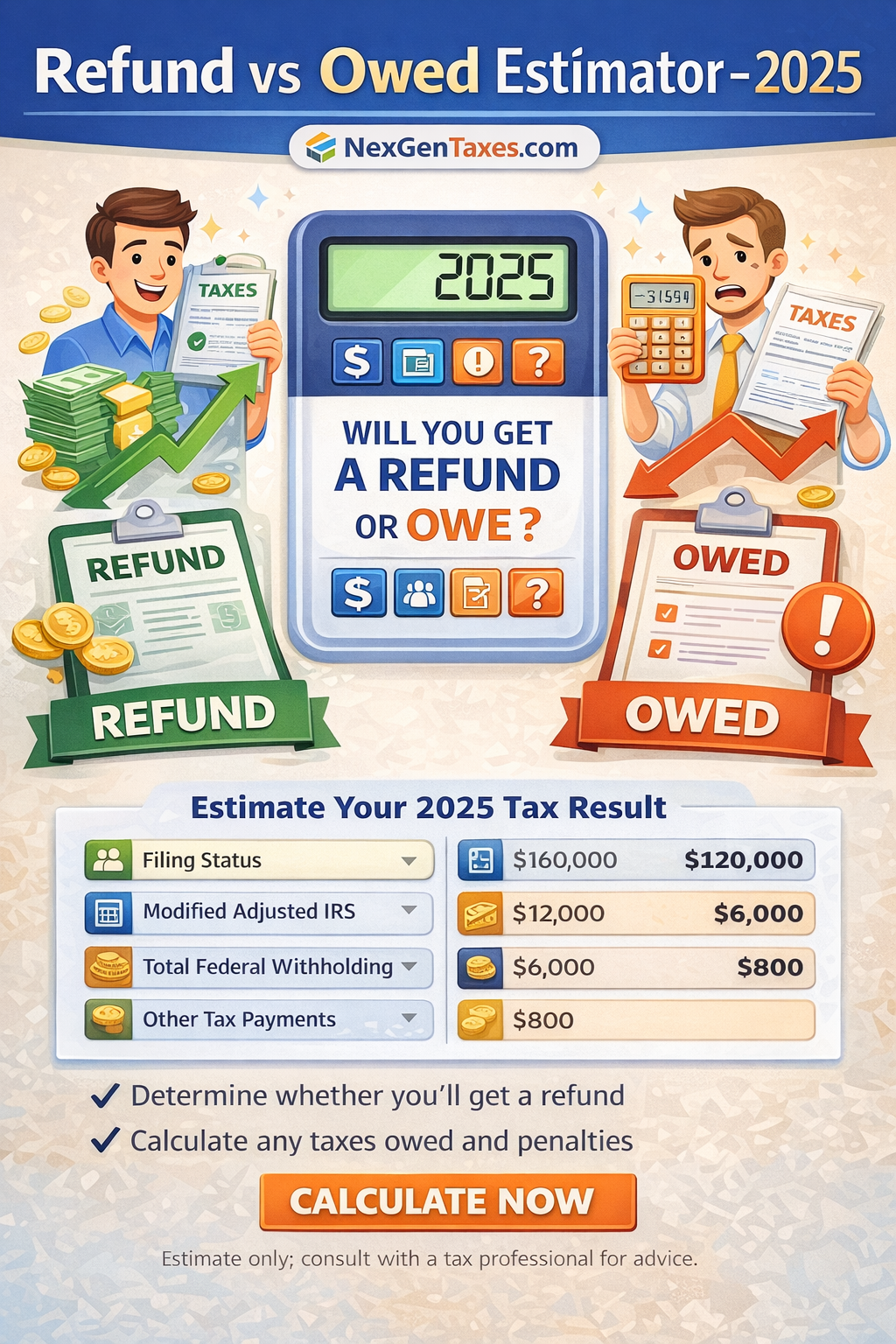

Estimate whether you’ll get a federal refund or owe money for tax year 2025 using filing status, income, withholding, and credits. This is a planning estimate (federal only).

Your refund (or balance due) is the difference between your total tax liability and what you’ve already paid through withholding and/or estimated payments. If you’ve paid more than you owe, you typically receive a refund; if you’ve paid less, you owe the difference. This estimator applies 2025 federal bracket logic and standard deduction assumptions (unless your situation requires itemizing).

If you want a plain-English explanation of why refunds happen and what affects them, H&R Block’s guidance is a useful overview, and NerdWallet’s explanation of refunds vs tax liability is also clear for most taxpayers. H&R Block on refunds and NerdWallet on tax refunds.

For official IRS information on refund timing and how to track a refund, see the IRS refunds page. IRS: Where’s My Refund?

Enter your 2025 income estimate, federal tax withheld (W-2 Box 2 plus estimated payments), and any credits you expect to claim. The result shows an estimated refund or amount owed, plus the calculation breakdown.

This estimator subtracts a 2025 standard deduction (by filing status) to estimate taxable income. If your itemized deductions are higher, your real taxable income may be lower, which can change the result. For a practical explanation of standard vs itemized deductions, see Intuit’s overview. TurboTax: itemized vs standard

Federal income tax is progressive: only the portion of taxable income in each bracket is taxed at that bracket’s rate. If you want a simple explanation of marginal vs effective tax rates, Fidelity explains it well. Fidelity: how tax brackets work

Credits reduce estimated tax (some are refundable in reality, which can change outcomes). After credits, the estimator compares what you owe to what you already paid through withholding/estimated payments. The difference is your estimated refund or balance due.

Planning note: this is a simplified federal estimator. It does not model self-employment tax, AMT, NIIT, capital gains tables, state taxes, or every refundable credit rule.

It’s a planning estimate based on standard deduction assumptions and federal brackets. Your actual result may differ due to itemized deductions, multiple income types, self-employment tax, state taxes, refundable credit rules, and other factors.

Common reasons include multiple jobs without coordinated W-4 settings, incorrect W-4 elections, significant 1099 or investment income, or major life changes (marriage, dependents, etc.). Adjusting withholding can reduce surprises at filing time.

Many e-filed refunds with direct deposit are issued quickly, but timing depends on IRS processing and your return’s complexity. You can track status through the IRS “Where’s My Refund?” tool. IRS refund tracking

The IRS offers payment plans and other options. Filing on time still matters even if you can’t pay in full. For an overview of IRS payment options, see the IRS payment plans page. IRS payment plans

Internal links help users navigate and help search engines understand your calculator cluster.

This calculator provides estimates for educational purposes only and is not tax, legal, or financial advice. Tax laws are complex and results may vary based on your complete situation. For personalized guidance, consult a qualified tax professional.

This calculator provides a planning estimate. For a result tailored to your full tax situation, you can reach out and we’ll take a quick look.

Contact NexGen Taxes