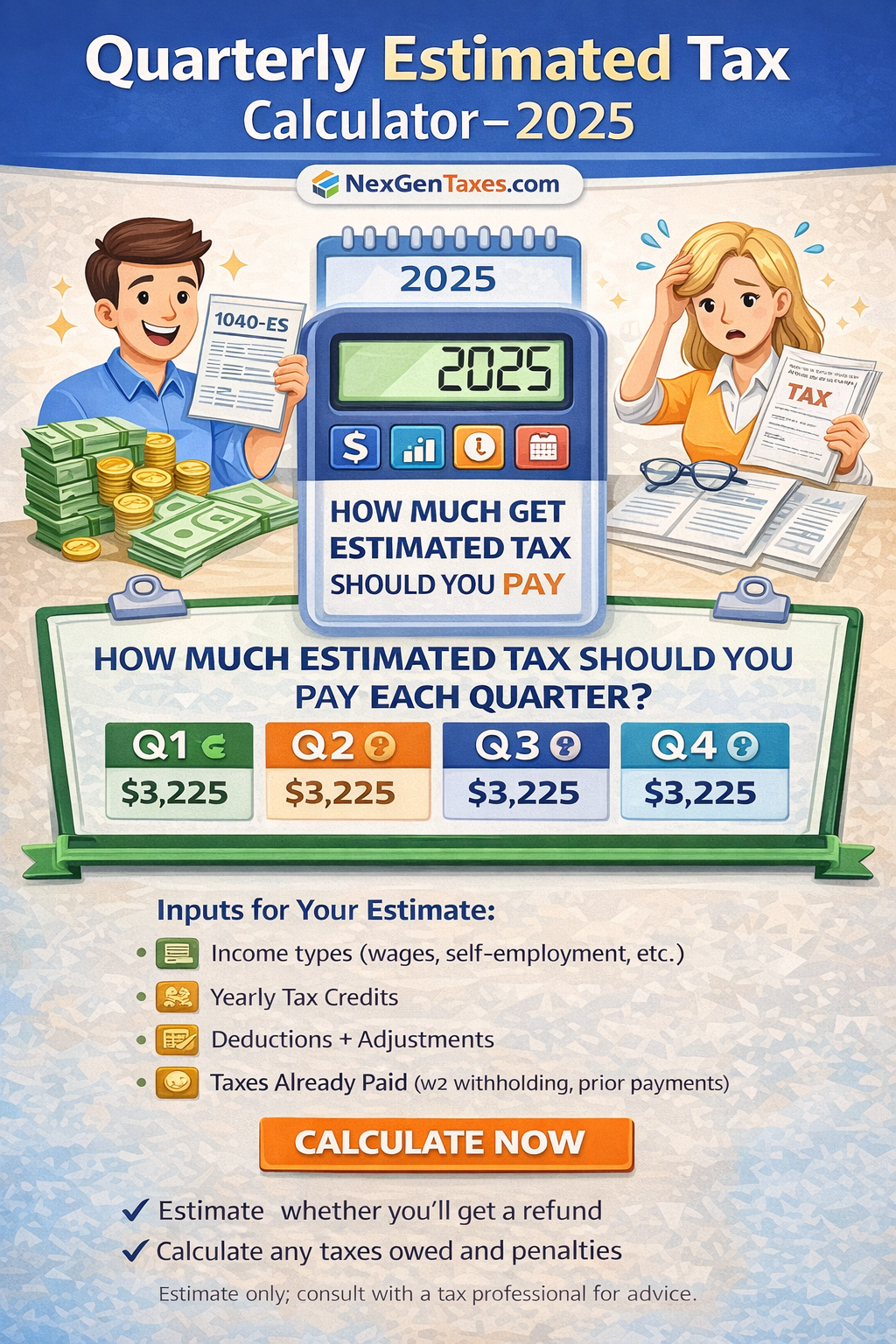

Quarterly Estimated Tax Calculator 2025

Calculate your quarterly estimated payments with safe harbor logic. Avoid underpayment penalties.

Plan Your Quarterly Tax Payments

If you have income that is not subject to withholding (self-employment, investments, rental income), quarterly estimated tax payments help you avoid penalties and cash-flow surprises. For additional plain-English context, see NerdWallet’s guide to quarterly taxes and Investopedia’s estimated tax overview.

- Estimate a quarterly payment amount

- Includes safe harbor logic (prior year method)

- Shows typical federal due dates

- Includes internal cross-checks with related calculators

Your Tax Information

Quarterly Payment Results

Typical federal due dates for 2025 estimates

Want this dialed in with your real return?

Safe-harbor rules are only one part of avoiding penalties. We can align estimates with self-employment tax, withholding strategy, and credits.

Talk to a tax proHow Estimated Taxes Work

Estimate Income

Project your total income for the year.

Estimate Tax

Apply brackets, deductions, and credits.

Subtract Withholding

Deduct W-2 withholding and other prepayments.

Split Payments

Divide what remains into quarterly payments.

Frequently Asked Questions

Stay on Top of Your Taxes

NexGen Taxes offers quarterly tax planning and estimated payment support.

View Our Services