What Is the QBI Deduction?

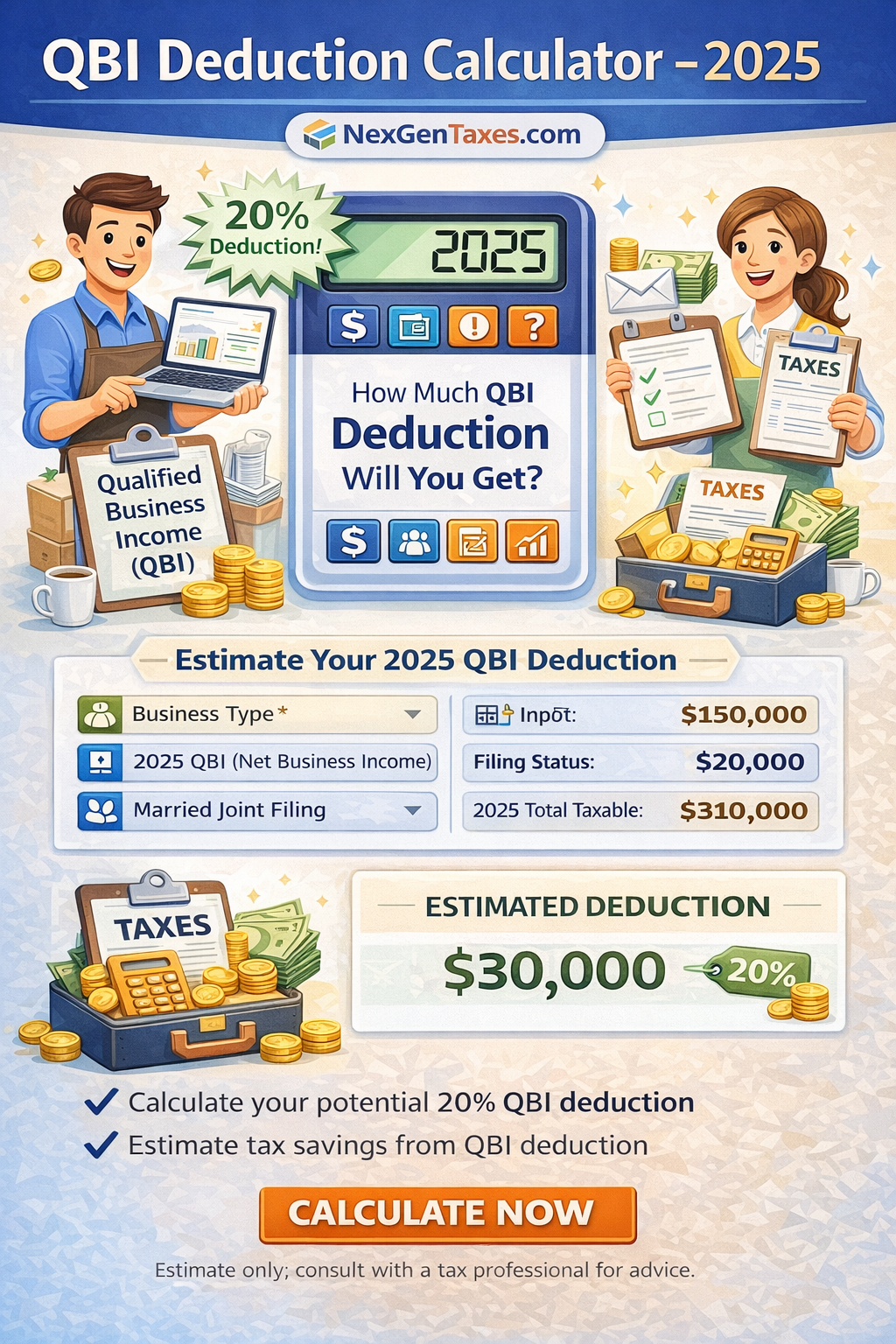

The Qualified Business Income (QBI) deduction, also known as the Section 199A deduction, allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income. This powerful tax break was created by the Tax Cuts and Jobs Act of 2017 and is available through 2025.

- Deduct up to 20% of qualified business income

- Available to sole proprietors, partnerships, and S-corps

- Accounts for SSTB phase-out rules and W-2 wage limitations

- Uses official 2025 IRS income thresholds

Enter your business details below to calculate your estimated QBI deduction and see how much you could save on your taxes.

Frequently Asked Questions About the QBI Deduction

What is the QBI deduction?

+

The Qualified Business Income (QBI) deduction, also known as the Section 199A deduction, allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income from pass-through entities such as sole proprietorships, partnerships, S-corporations, and some trusts and estates. This deduction was introduced by the Tax Cuts and Jobs Act of 2017 and is currently available through 2025. The deduction is designed to provide tax relief to pass-through business owners similar to the reduced corporate tax rate.

Who qualifies for the Section 199A deduction?

+

To qualify for the Section 199A deduction, you must have qualified business income from a pass-through entity. This includes sole proprietorships, partnerships, S-corporations, and certain trusts and estates. The deduction is available regardless of whether you itemize deductions or take the standard deduction. However, the amount you can deduct may be limited based on your total taxable income, the type of business you operate (SSTB vs non-SSTB), W-2 wages paid by the business, and the qualified property held by your business.

What is an SSTB (Specified Service Trade or Business)?

+

A Specified Service Trade or Business (SSTB) is a trade or business involving the performance of services in certain professional fields. These include health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, investing and investment management, trading, dealing in securities, partnership interests, or commodities, or any business where the principal asset is the reputation or skill of one or more employees or owners. For taxpayers with income above certain thresholds, the QBI deduction for SSTBs is reduced during the phase-out range and completely eliminated above the phase-out range.

How is the QBI deduction limited for high-income taxpayers?

+

For 2025, taxpayers with taxable income below $191,950 (single) or $383,900 (married filing jointly) can generally claim the full 20% QBI deduction without limitations. Above these thresholds, the deduction phases out over a $50,000 range for single filers or $100,000 range for joint filers. For non-SSTB businesses above the threshold, the deduction is limited to the greater of: (1) 50% of W-2 wages paid by the qualified business, OR (2) 25% of W-2 wages plus 2.5% of the unadjusted basis immediately after acquisition (UBIA) of qualified property. For SSTB businesses, the deduction is completely eliminated once taxable income exceeds $241,950 (single) or $483,900 (MFJ).

Do I need to itemize deductions to claim the QBI deduction?

+

No, you do not need to itemize deductions to claim the QBI deduction. The QBI deduction is taken as a deduction from taxable income on your Form 1040, not as an itemized deduction on Schedule A. This means it is available to taxpayers who take the standard deduction as well as those who itemize. The QBI deduction reduces your taxable income but does not reduce your adjusted gross income (AGI) or your self-employment tax liability.

What is UBIA and why does it matter for my QBI deduction?

+

UBIA stands for Unadjusted Basis Immediately After Acquisition of qualified property. It represents the original cost basis of tangible, depreciable property that is used in your qualified trade or business at the close of the tax year and for which the depreciable period has not ended. UBIA becomes particularly important when your taxable income exceeds the threshold amounts. In such cases, your QBI deduction may be limited, but you can use the alternative calculation of 25% of W-2 wages plus 2.5% of UBIA. This formula benefits capital-intensive businesses that have significant equipment or property but may not pay substantial W-2 wages.