Compare the 2025 IRS standard mileage method to the actual expense method to see which produces a larger business vehicle deduction.

The IRS sets a standard mileage rate each year. For 2025, the business rate is $0.70 per mile. This calculator compares: Standard mileage (business miles × 0.70) versus Actual expenses (total vehicle expenses × business-use %). The IRS standard rate is published here: IRS standard mileage rates.

If you want a plain-English overview of when mileage tends to beat actual (and vice versa), NerdWallet’s comparison is a useful reference: Mileage vs actual expenses.

Business miles × 0.70 (2025). This method is simple and requires strong mileage records.

Total vehicle expenses × business-use %. Business-use % is computed as business miles ÷ total miles (total miles includes personal miles, which are not deductible but do affect the percentage).

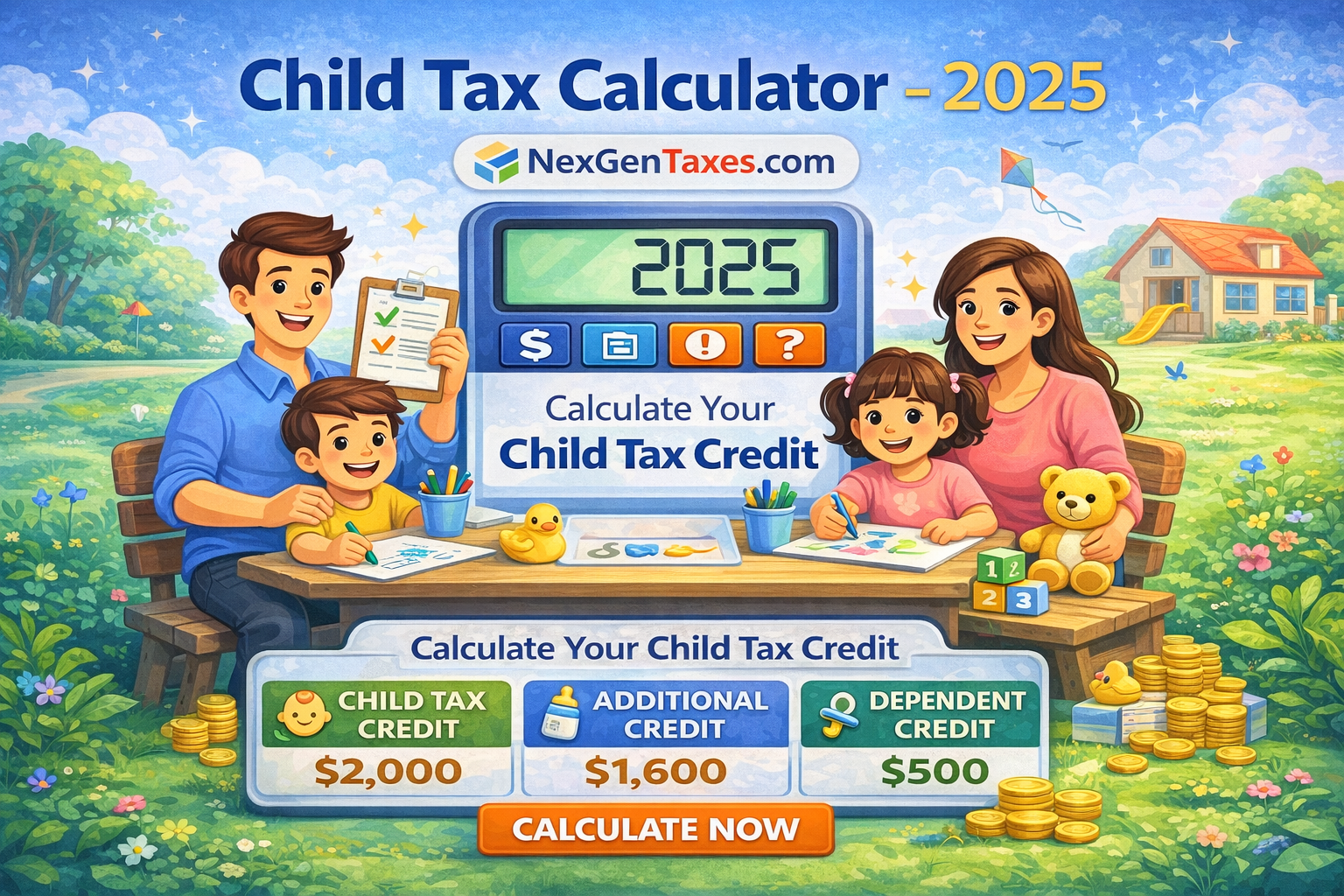

This calculator provides a planning estimate. For guidance based on your complete tax situation, you can contact NexGen Taxes.

Contact NexGen TaxesThe results panel shows both deductions side-by-side (Standard Mileage vs Actual Expense), plus the winner and the dollar difference.

Personal/commuting miles are not deductible, but they help compute total miles. Total miles are needed to calculate business-use % for the actual expense method.

Not in this version. If you want, we can add optional parking/tolls fields and include them in the actual expense total.

Disclaimer: This calculator provides estimates for educational purposes only and does not constitute tax advice. Vehicle deduction rules can be fact-specific.