Complete Payroll Services for Businesses of All Sizes

Online Payroll Services for Businesses

NexGen Taxes is a trusted provider of full-service payroll solutions. We manage all your business needs, from payroll processing and check printing to direct deposits. Our experts handle monthly and annual tax filings and payments. Outsource payroll to us and focus on growing your business while we take care of the complexities.

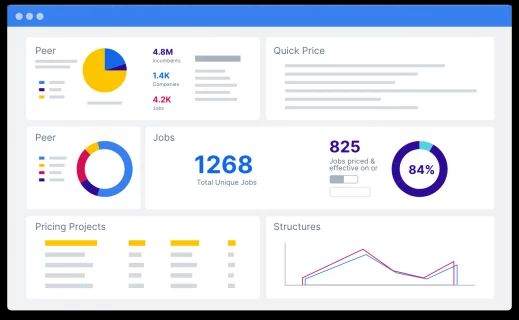

Efficient Payroll Reports at Your Fingertips

NexGen Pros provide comprehensive payroll reports, including detailed payroll summaries, tax filing and deposit records, and employee contribution histories. With our third-party professional payroll solutions, you’ll have easy access to all the reports you need to stay on top of your business’s financials and compliance.

Comprehensive Payroll Tax Solutions

Payroll taxes are withheld from employee wages based on total earnings and W-4 information. These taxes include federal and state income taxes, local income tax, federal and state unemployment taxes, as well as Medicare and Social Security taxes. With NexGen’s outsourced payroll services, we manage your payroll tax responsibilities, ensuring accurate calculations and timely tax filings, so your business can stay focused on what matters most

Payroll Compliance and Risk Management Solutions

Ensuring payroll compliance is crucial for every business. NexGen Taxes’ payroll management experts handle all aspects of payroll compliance, from tax calculations to timely filings. Our team ensures that your business adheres to federal, state, and local tax laws, reducing the risk of penalties and audits. Let us manage this for you, so you can focus on running your business with confidence and ease.

FAQs

Payroll services for businesses encompass the processes of calculating and distributing employee wages, handling payroll taxes, and ensuring compliance with relevant labor laws. These services can be outsourced or managed in-house through payroll systems and software integration.

Looking for professional payroll solutions? Contact NexGen Taxes for seamless payroll management and tax compliance.

NexGen Taxes provides comprehensive payroll services for businesses of all sizes. From small business payroll services to large corporate payroll solutions, we offer end-to-end payroll services, including tax management, employee pay processing, and regulatory compliance.

Ready to simplify payroll? Get started with NexGen Taxes for expert payroll solutions today!

Online payroll services allow businesses to manage payroll remotely, ensuring faster, more efficient processing of employee salaries, taxes, and benefits. These payroll online services are designed to reduce errors and save time, providing an all-in-one payroll solution for your business.

Save time and reduce errors with NexGen Taxes’ online payroll services. Sign up now!

The cost of payroll services varies depending on the size of your business and the complexity of your payroll needs. NexGen Taxes offers competitive payroll services fees with transparent payroll services pricing, ensuring you get the best value for your business.

Want affordable payroll solutions for your small business? Request a free quote from NexGen Taxes today!

Outsourced payroll services include everything from payroll processing to payroll tax management. NexGen Taxes’ outsourcing payroll services ensure accurate payroll processing, timely tax payments, and compliance with both federal and state tax regulations.

Streamline your payroll today by outsourcing with NexGen Taxes. Get expert support now!

NexGen Taxes offers payroll and tax compliance management, ensuring that your business remains in full compliance with federal, state, and local payroll tax regulations. Our team of experts helps manage payroll taxes, including employer payroll taxes, to minimize the risk of costly penalties.

Need help with payroll taxes? Contact NexGen Taxes for comprehensive payroll tax support.

For small businesses, managing payroll can be time-consuming and complex. Professional payroll solutions like those from NexGen Taxes offer reliable payroll processing, ensuring that your payroll is always accurate, on time, and fully compliant with tax laws.

Focus on growing your business while we handle your payroll. Start with NexGen Taxes’ small business payroll services today!

NexGen Taxes stands out as one of the best payroll services due to our holistic payroll solutions, advanced payroll services, and commitment to customer satisfaction. Our complete payroll support is ideal for businesses of all sizes, whether you’re looking for small business payroll solutions or corporate payroll services.

Discover why NexGen Taxes is the top-rated payroll service provider. Join us now!

At NexGen Taxes, we prioritize the security of your payroll data. We use integrated payroll processing systems with robust data encryption and compliance with industry standards to ensure that your sensitive business and employee information is always secure.

Protect your payroll data with NexGen Taxes’ secure payroll services. Get in touch for more details!

We specialize in construction payroll services, which cater to the unique needs of construction companies. Whether it’s managing union dues, workers’ compensation, or certified payroll for government contracts, NexGen Taxes provides tailored solutions for your industry.

Get expert payroll solutions for your construction business with NexGen Taxes. Contact us today!

Using online payroll services for small business offers several advantages, including reduced administrative burden, accurate tax filing, and efficient processing. NexGen Taxes provides small business payroll services that simplify these tasks, saving you time and money.

Make payroll easier for your small business. Start with NexGen Taxes’ online payroll service now!

In-house payroll requires managing the process internally, while outsourced payroll services like those offered by NexGen Taxes allow your business to rely on experts for payroll processing, compliance, and reporting. Outsourcing helps save time, reduce errors, and ensures compliance with tax regulations.

Let us handle your payroll. Outsource with NexGen Taxes for reliable payroll management!

Ask a Question

Find comfort in knowing a payroll management expert is only an email or phone-call away.

We Are Here to Help

Reach out to us today to determine how to best serve you.

Send Us a File

Use our convenient Secure repository to securely deliver a file directly to a member of our firm.

Talk to our experts today

We are just a message away