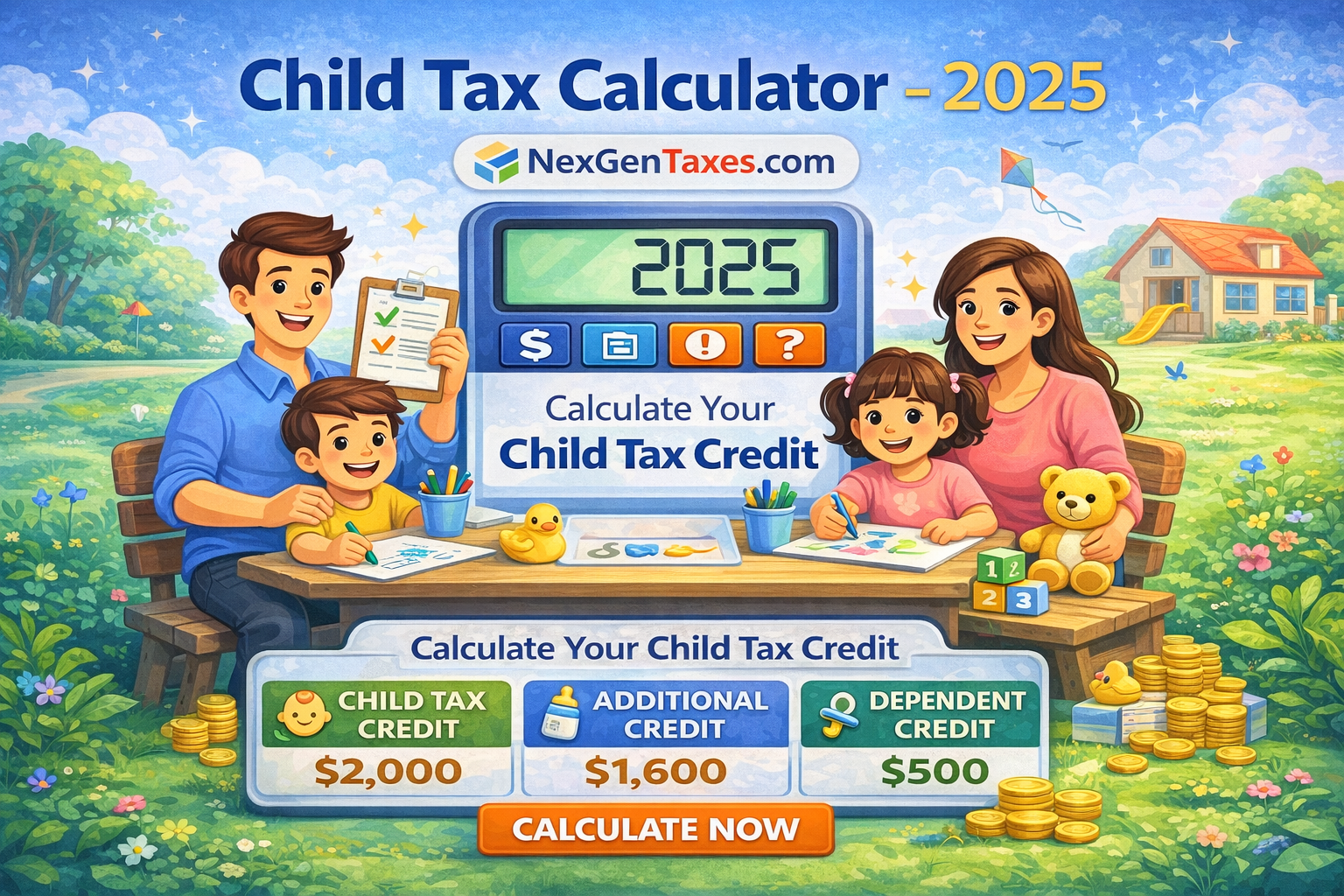

Child Tax Credit Calculator

Estimate your 2025 Child Tax Credit (CTC), refundable Additional Child Tax Credit (ACTC), and Credit for Other Dependents (ODC) based on income, filing status, and dependents.

This calculator estimates the Child Tax Credit (CTC) (up to $2,200 per qualifying child under age 17), the refundable Additional Child Tax Credit (ACTC) (up to $1,700 per qualifying child), and the Credit for Other Dependents (ODC) ($500 per eligible dependent who does not qualify for CTC).

For definitions and eligibility basics, see the IRS Child Tax Credit overview. IRS overview Refundability and calculation mechanics are detailed through Schedule 8812 guidance and related IRS topics. Schedule 8812

Leave fields blank to treat them as zero. This tool is intended for planning and education.

This calculator uses common planning values for 2025: up to $2,200 per qualifying child for the Child Tax Credit, a refundable ACTC cap of up to $1,700 per qualifying child, and a $500 credit for other dependents. For background on credit definitions and eligibility, see the IRS Child Tax Credit page. IRS overview

The calculator applies the standard phaseout thresholds ($200,000 for Single/HOH/MFS and $400,000 for MFJ) and reduces the credit by $50 for each $1,000 (or fraction) above the threshold. This aligns with the standard mechanics described in IRS Schedule 8812 materials. Schedule 8812

For the refundable portion, the calculator uses the common 15% earned-income approach above $2,500 and then applies caps. For IRS explanations of ACTC concepts and refundability, see IRS Topic 602. IRS Topic 602

Planning note: this tool does not model every IRS exception (for example, certain edge cases and special residency rules).

No. This is an estimate for planning purposes only. The final credit is determined on your tax return using Schedule 8812 and may differ based on additional rules.

Yes. The calculator estimates both the nonrefundable portion and the refundable ACTC portion (subject to earned-income limits).

Use a planning estimate of Modified AGI (MAGI) for phaseout and earned income for the refundable portion. If you are unsure, use conservative numbers and confirm with your return or preparer.

No. Certain special situations are not modeled. This is designed for high-level planning and education.