Congratulations! You were able to set up your non-profit to work on the cause you care about. You also did the hard work of getting the non-profit status established with the IRS. Now what? Here are some of your questions answered about tax filing for the non-profit.

Yes! Nonprofit organizations that have been granted tax exemption by the IRS are required to file an IRS Form 990, an annual information return. You might wonder why, given that such organizations are exempt from paying taxes anyway. To put it in layman’s terms – your nonprofit organization is required to ‘justify’ its tax-exempt status. In other words, the annual tax return of a 501(c)(3) organization proves to the IRS that the nonprofit is living up to its charitable purpose.

Unfortunately, there are always some who might take advantage of a nonprofit’s tax-exempt status for personal financial gain. For example, an individual could create a shell company and submit invoices to obtain payments for services not rendered or deliver goods or services marked up excessively. It is for reasons such as these that larger nonprofits, and nonprofits that are recipients of grants, are required to have an independent accountant perform an audit.

IRS Form 990 is the annual information return or tax return filed by tax-exempt organizations with the IRS that details financial information, including statements of revenue and expenses and balance sheets. Form 990 is an annual compliance report of your organization to the IRS that documents:

Information on governance, documentation of decisions made, and written policies to demonstrate accountability and transparency.

That your tax-exempt organization is adhering to best practices and stays within the confines of its tax-exempt purpose.

That your organization remained compliant with applicable federal tax law, from payroll and information reporting to unrelated business income taxes, and so on.

Generally, tax-exempt organizations under section 501(a) of the Internal Revenue Code (which includes 501(c)(3) nonprofits) are required to file annual information returns. Failure to file the IRS Form 990, filing after the due date, or failing to file an extension of time to file, could result in the IRS assessing penalties of up to $20 or more per day. The penalty assessed largely depends on annual gross receipts, for each date the information return is overdue. It is worth noting that penalties will also be assessed if a tax-exempt organization files on time but files inaccurate information or omits any required information. Your information return is considered filed only if it is complete and accurate.

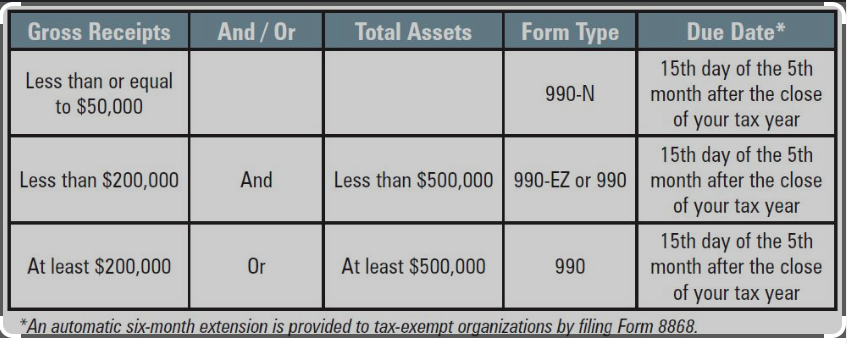

There are several types of IRS Form 990s, which are determined by the financial standing of a nonprofit. Nonprofit organizations are required to file form 990 based on their assets, gross receipts, and public charity status.

To ensure that your tax returns are filed correctly and on time, the team at NexGen Taxes keep track of due dates on your behalf, file extensions when necessary, and triple-check every tax return to account for errors before filing.

It is not uncommon for nonprofit organizations to file the wrong type of Form 990. All too often, Form 990s might be missing information or even an entire schedule. When this happens, the IRS generally sends back your information return along with one of the following letters:

If your organization has received one of these letters, Contact Us immediately. Our nonprofit tax filing experts here at NexGen Taxes will assist you in providing a corrected return, along with your explanation detailing why your organization failed to submit the required information. Once you receive one of these letters from the IRS, you have 10 days from the date of the letter to correct your mistake.

If your organization fails to file its required information return for 3 consecutive years, the IRS will automatically revoke your tax-exempt status and place your organization on its Auto-Revocation List. Revocation means that your nonprofit organization will now be liable to pay federal income tax and often state income tax on annual revenue. In addition, your donors will no longer be able to make tax-deductible contributions.

If your tax-exempt status has been revoked, reach out to the team at NexGen Taxes today, and we will help you reinstate it on your behalf. If your organization has reasonable cause for failure to file on time, we will also request an abatement of penalties assessed.

The maximum penalty the IRS can assess if an organization fails to file its return is the lesser of either 5% of the organization’s gross receipts or $10,000 for the year. For nonprofit organizations with over a million dollars in gross receipts per annum, the penalty is $100 per day with a maximum of $50,000.

To avoid these penalties, your nonprofit must remain aware of Form 990 return due dates, which vary based on your organization’s accounting periods or tax timetable.

Form 990 due dates depend on the specific tax calendar that your nonprofit follows. This table outlines different due dates based on when your nonprofit’s tax year ends:

Every nonprofit organization is responsible for filing its taxes, in fact, there are several people within the non-profit organization who are responsible for filing its taxes.

The first person you should know about is the Board of Directors. The Board of Directors is often made up of volunteers (or paid employees) who oversee the day-to-day operations of your nonprofit organization and help ensure that all financial responsibilities are met. It’s their responsibility to make sure that all tax filings are kept current and accurate so that you don’t incur any penalties or fines from the IRS or state department.

Another person who might be involved in helping prepare your nonprofit’s tax returns each year is an accountant or CPA (certified public accountant). CPAs handle tax preparation for individuals and businesses alike, so if you don’t have experience preparing tax returns yourself, it might be worth hiring one at least once every year to do so for you. Reach out to our qualified team of Tax experts to help you get started with tax filing for your non-profit.

In general, non-profit/exempt organizations are required to file annual returns, although there are exceptions. If an organization does not file a required return or files late, the IRS may assess penalties. In addition, if an organization does not file as required for three consecutive years, it automatically loses its tax-exempt status. You can check which 990 Series Form your organization needs to file on the IRS’s Website. You can now file your 990 Form online.

If you don’t file your nonprofit taxes on time, you may be hit with tax penalties and fines.

Per IRS, if an organization fails to file a required return by the due date (including any extensions of time), it must pay a penalty of $20 a day for each day the return is late. The same penalty applies if the organization does not give all the information required on the return or does not give the correct information.

The use of a paid preparer doesn’t relieve the organization of its responsibility to file a complete and accurate return.

In general, the maximum penalty for any return is the lesser of $10,500 or 5 percent of the organization’s gross receipts for the year. For returns required to be filed in 2021, for an organization that has gross receipts of over $1,084,000 for the year, the penalty is $105 a day up to a maximum of $54,000. For returns required to be filed in 2022, for an organization that has gross receipts of over $1,094,500 for the year, the penalty is $105 a day up to a maximum of $54,500.

If the organization is subject to this penalty, the IRS may specify a date by which the return of correct information must be filed. If the return is not filed by that date, an individual within the organization who fails to comply may be charged a penalty of $10 a day. The maximum penalty on all individuals for failures concerning a return shall not exceed $5,000.

Penalties for failure to file may be abated if the organization has reasonable cause for the failure to file timely, completely, or accurately.

Please keep in mind, automatic revocation of your tax exemption status occurs when an exempt organization that is required to file an annual return (e.g., Form 990, 990-EZ, or 990-PF) or submit an annual electronic notice (Form 990-N, or e-Postcard) does not do so for three consecutive years. Under the law, the organization automatically loses its federal tax exemption. The NexGen Taxes team can help you get this tax-exemption status reinstated. Reach Out to us today!

Some of the tips you can follow to file taxes are:

We hope you now have most of your questions answered for filing taxes for your non-profit. If you have any questions about how to file, please reach out to our team of qualified tax professionals. We’d love to hear from you!